DRAM价格上涨通常与第三季度和第四季度推出的新款智能手机有关,但由于疫情影响消费的方式,使得消费变得谨慎。

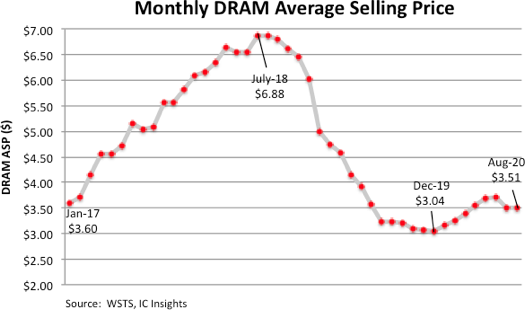

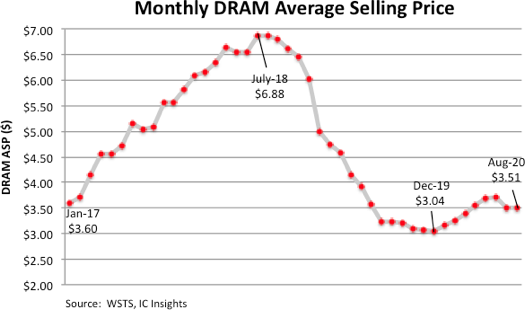

据IC Insights十月更新的McClean报告显示,DRAM的月平均销售价格(ASP)在2018年下半年呈现急剧下降的趋势,一路跌至2019年12月的3.04美元。由于新冠疫情的影响,迫使人们迅速转战线上教育,购物,商业活动,导致个人和企业计算系统对内存需求增长,因此DRAM的价格在2020年上半年呈现反弹。另外,线上网络活动激增也导致数据服务器对DRAM的需求增加。(图1)显示DRAM的平均售价在2020年6月涨至3.70美元,在7月和8月逐渐降至3.51美元。

(图1)

IC Insights预计至今年年底DRAM价格将逐渐降低。虽然运算市场的DRAM需求依然保持稳定健康,但至年末不会再出现明显的增长。DRAM需求(和价格)的大幅增涨通常发生在每年的第三季度和第四季度,并且与新智能手机的推出相吻合,但疫情的因素打乱了存储市场规律,让消费者的购买欲变得保守,可能今年的销量将不如往年强劲。目前几家手机制造商已经推出支持5G的手机,年底前其他手机制造商也将纷纷效仿。预计今年5G智能手机的总出货量将达到2亿部,但其销量并不会让DRAM的供应商和市场出现供不应求的局面。

今年,游戏主机市场可能是推动DRAM需求增长的环节。索尼和微软将在2020年底之前发布他们的新一代游戏机。微软计划在11月10日推出Xbox Series S和Series X,索尼则计划在11月12日向特定市场发布其PlayStation 5(PS5)。DRAM供应商希望对借此部分抵消由于智能手机出货量减少而导致的损失。

目前,三大DRAM供应商(三星,SK Hynix和美光)预计在今年第四季度和明年第一季度的 DRAM销量将会呈现疲软态势。就美光而言,由于美国“华为禁令”已于2020年9月15日生效,无法向华为销售DRAM。且华为在美光的DRAM季度销售额中至少占5亿美元,这也是美光对今年第四季度和明年第一季度的销量预测疲软的主要原因。美光虽然有可能被授予向华为出售部分产品的许可,就像英特尔和AMD被授予向华为出售其部分产品的许可一样。但即便获得了许可,美光在今年第四季度的DRAM的销量也不会太大的增长,因为华为在9月禁令发布之前订购了尽可能多的DRAM,以保持其生产线的正常运转。据悉,华为大约有六个月的DRAM库存。

由于新冠疫情的影响,让DRAM供应商和系统OEM厂商很难依据销售需求规划下一个季度的安排。但随着经济的复苏和经济可行性的改善,企业将能再次做出长期投资的决策。

预计在未来三年,随着库存售罄,过度到更小的工艺节点,服务器和PC市场的持续需求,5G智能手机的出货量(预计在2021年将达到5亿部)和其他新兴应用市场,将为DRAM市场提供两位数的强劲增长。

英文原文内容:

DRAM Price Erosion Expected Through the End of 2020

Price jump that typically coincides with the introduction of new smartphone models in 3Q and 4Q is not expected due to disrupted buying patterns and cautious discretionary spending.

IC Insights’ October Update to The McClean Report showed the monthly average selling price (ASP) of DRAM started on a steep downward trend in the second half of 2018 that eventually bottomed out at $3.04 in December 2019. DRAM prices rebounded in the first half of 2020 as memory demand grew for personal and enterprise computing systems after the Covid-19 virus forced a rapid and dramatic shift to online-based education, shopping, and business activity. DRAM demand also came from new data center server computers that were needed to handle the surge of online activity. Figure 1 shows that the DRAM ASP climbed to $3.70 in June 2020, before tapering off to $3.51 in July and August this year.

Figure 1

IC Insights now projects modest DRAM price erosion through the end of this year. Although DRAM demand from the computing segment remains healthy, it has stabilized and is not expected to show a marked increase through December. A substantial jump in DRAM demand (and prices) that often takes place in the third and fourth quarters of each year and that coincides with the introduction of new smartphone models, is not likely to be as strong this year due to Covid-19 disrupting typical seasonal buying patterns and consumers being more cautious with their discretionary spending. Several phone makers have already introduced their 5G-capable handsets. Other OEMs are expected to follow suit by the end of December. While total 5G smartphone shipments are expected to reach 200 million units this year, IC Insights does not believe that sales of these leading edge handsets will be enough to catch DRAM suppliers off-guard and create a DRAM supply shortage.

One segment that may provide a boost to DRAM demand late this year is the game console market. Sony and Microsoft will release their new generation game consoles before the end of 2020. Microsoft plans to debut its Xbox Series S and Series X on November 10 and Sony will release its PlayStation 5 (PS5) to select markets on November 12. DRAM suppliers are hoping that demand for the new consoles will offset some of the lost revenue they expect on account of fewer smartphone shipments.

Currently, the big-three DRAM suppliers (Samsung, SK Hynix, and Micron) anticipate softer DRAM sales in calendar 4Q20 and in 1Q21. In Micron’s case, it is banned from selling DRAM to Huawei in China due to trade restrictions that went into effect on September 15, 2020. It is believed that Huawei accounted for at least $500 million in quarterly DRAM sales for Micron, and was the primary reason for Micron’s softer DRAM sales projections for the balance of this year and the first quarter of 2021. There is an outside chance that Micron could be granted a license to sell some of its products to Huawei just as Intel and AMD were granted a license to sell some of their products to the Chinese electronics giant. However, even if granted a license, Micron’s 4Q20 DRAM sales would not likely benefit tremendously since Huawei ordered as much DRAM as it could ahead of the September ban in order to keep its production lines running. It is thought Huawei has about six months of DRAM inventory.

Covid-19 has made it difficult for DRAM suppliers and system OEMs to plan much further out than one quarter as they anticipate sales demand. However, as economic recovery begins and visibility improves, businesses will again be able to make long-range investment decisions. Inventory depletion, a transition to smaller process nodes, ongoing demand from server and PC markets, 5G smartphones shipments that some predict will reach 500 million units in 2021, and other emerging system applications are forecast to provide the DRAM market with strong double-digit growth in each of the next three years.